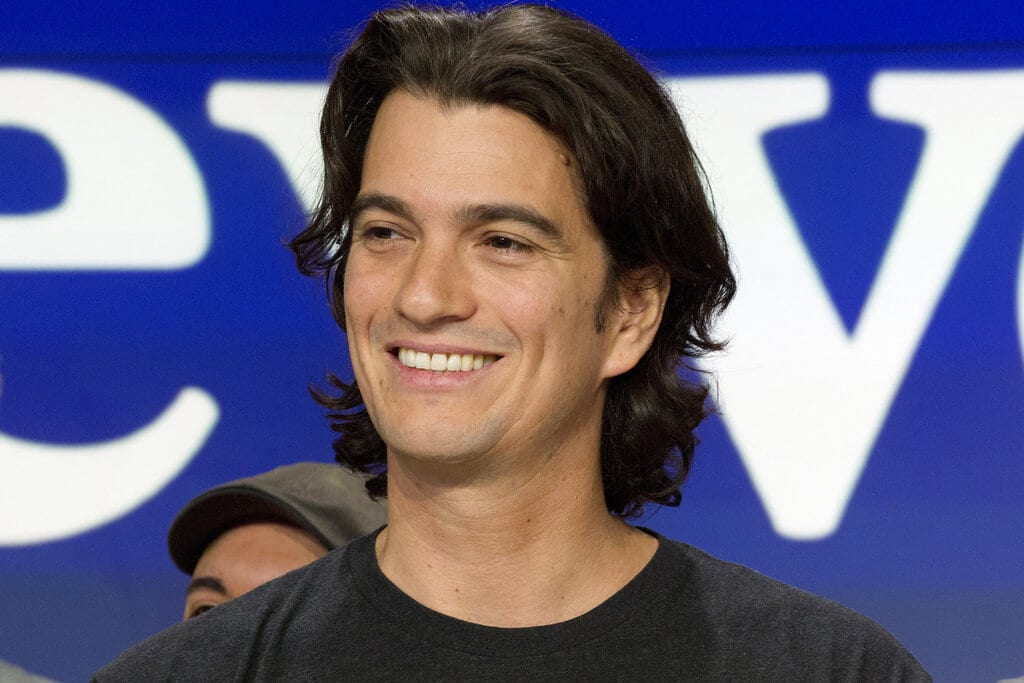

Former WeWork CEO Adam Neumann has finally found the price it takes to make him go away.

His renegotiated exit package, according to the Wall Street Journal, is made up of $245 million in company stock and $200 million in cash.

Neumann founded the office rental company, directed the path toward enormous profit and then held on through an equally meteoric fall.

His missteps muddled the 2019 attempt to take the company public, but the settlement appears to have paved the way for a second attempt at an IPO.

Primary investor SoftBank originally agreed on an exit amount two years ago but backed out of that deal, citing pandemic-related changes.

The payout was revealed through regulatory filings designed to take WeWork public through a SPAC merger with BowX Acquisition Corp.

The filings show WeWork also moved to allow Neumann generous terms to refinance $430 million in debt and for a company controlled by Neumann to sell almost $580 million in WeWork stock.

Last week, WeWork reported a $2.06 billion loss in its quarterly filing but said its prospects are improving as people return to office life.

Neumann has been negotiating his exit since 2019, when the company regulatory filings for its IPO uncovered major losses and Neumann-led business practices that raised eyebrows and led to his being forced out as CEO.

A few weeks after the failed IPO, WeWork was bleeding cash and Softbank offered the initial exit package.

When Softbank backed out, Neumann sued.

The Journal wrote that the settlement is believed to tie up any loose ends and finish the renegotiation.

The regulatory filings also showed that, along with the renegotiated exit package, WeWork confirmed reports that Neumann helped WeWork move toward the IPO by meeting with the BowX team.

Add comment