Americans are BROKE! 😬

Let’s take a look at the stats, shall we?

Brace yourselves.

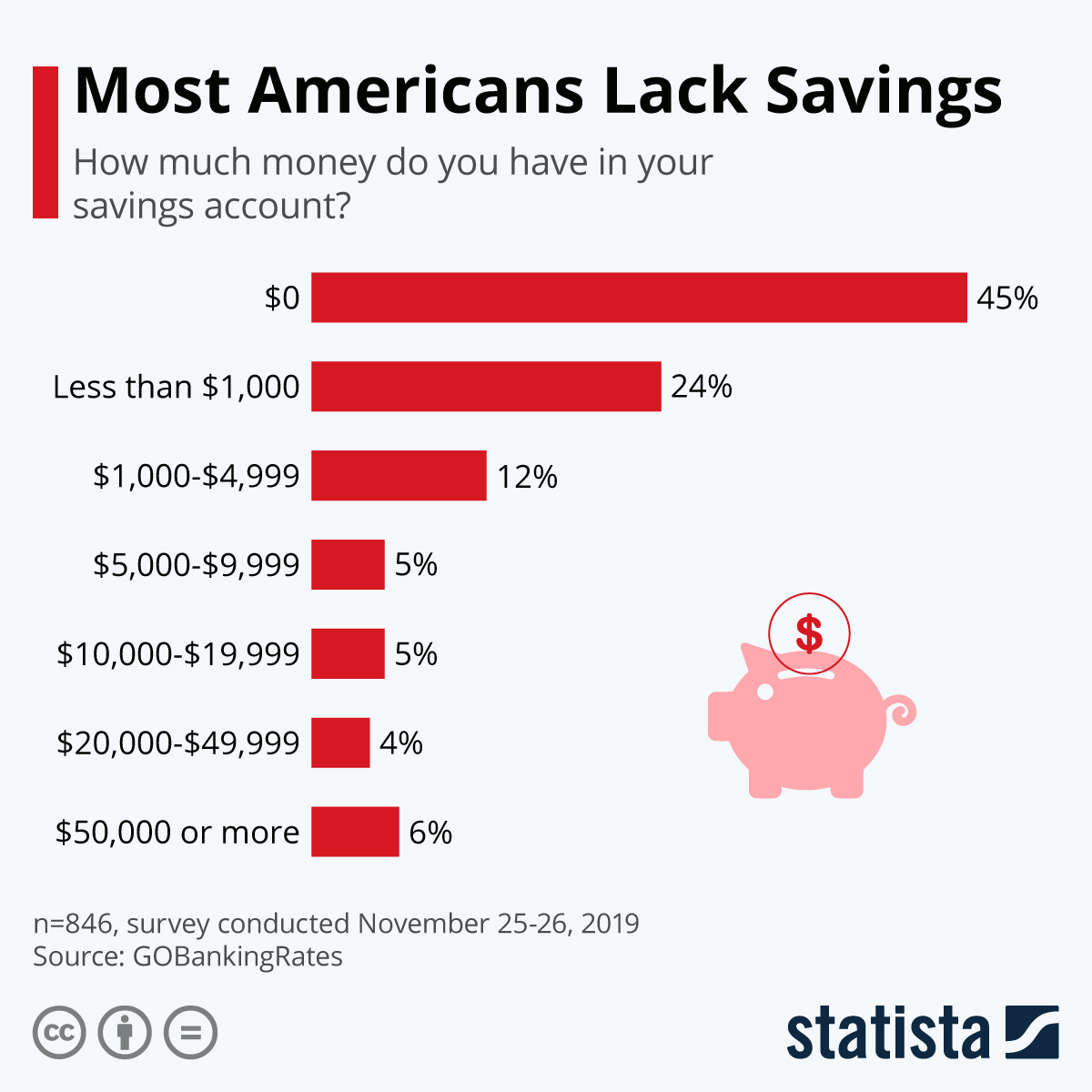

Most Americans Lack Savings

60% of Americans don’t have enough to cover an unplanned expense.

Uh oh.

Nearly 6 in 10 Americans don’t have enough savings to cover a $500 or $1,000 unplanned expense, according to a report from Bankrate.

The problem is not that Americans are making too little. The issue stems from the fact that as peoples’ wages increase, so do their expenses.

Let’s dive a little deeper as to why Americans are struggling with their finances…

10 Reasons Americans are BROKE!

45% of Americans don’t have a dollar in their savings accounts – Here are 10 reasons why.

1. They spend more than they have.

These credit cards are doing more harm than good.

Having a credit card is a privilege.

Use a credit card the wrong way and you could be in A LOT of trouble…

Debt, interest, financial ruins… oh my! It’s just unnecessary stress.

The purpose of a credit card should be for 3 reasons.

- To build credit and have a GOOD credit score. Good credit will come in handy when it’s time to get a loan.

- To have the ability to not carry cash and worry about getting robbed. Debit cards aren’t great, because if someone hacks into your account they can drain your money.

- To have the ability to dispute a charge if you don’t get the product or service as expected. I’ll dispute anything if it’s not as I expect.

2. They have children they can’t afford.

It costs an average of $272,049 to raise a child from birth to age 17.

This does not include the cost of a college education.

Raising a child can be rewarding emotionally but very costly financially.

According to the U.S. Department of Agriculture, the average cost of raising a child to age 18 was $233,610 as of 2015.

With an annual adjustment for inflation of 2.2% each year factored in, the lifetime cost of raising a child born in 2022 could be estimated at $272,049.

Considering the fact that most Americans don’t have a dollar to spare, it’s quite stifling to understand how people are having children without being able to afford them.

Personally, that would stress me out… A LOT.

3. They choose not to save.

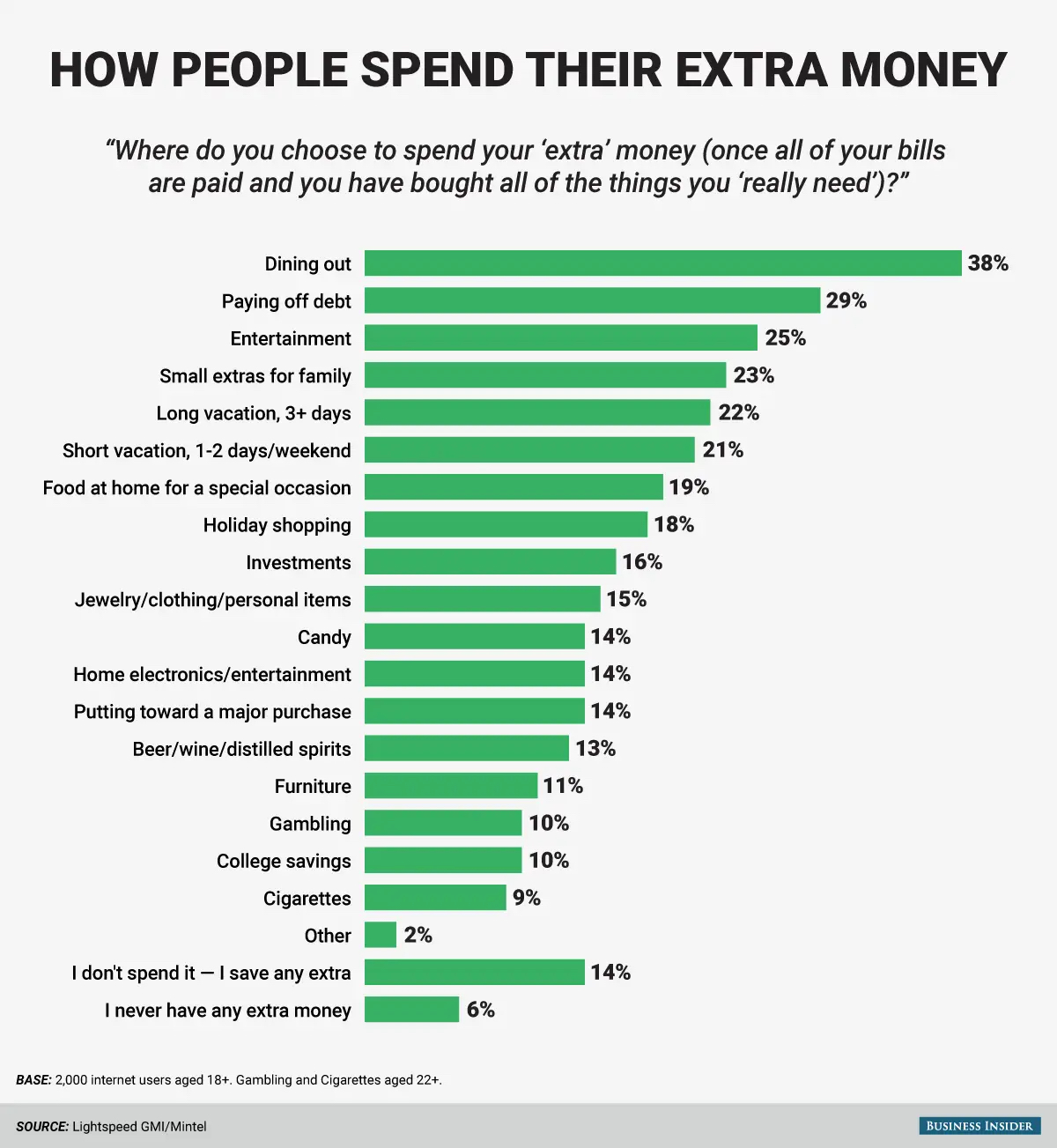

Paychecks go up and Americans start to get a little too comfortable with spending their “extra” cash.

Dining out? How do people afford this?

The food tastes better at home, I promise.

Cooking is very useful and quite delicious. It’s a great way to bond with family, friends, and significant others.

Even better, you can impress guests by hosting little get-togethers and cooking for them!

Everybody saves money, the portions are larger, and the food is healthier (if you cook the right foods), all in the comfort of your own home.

It’s all about the mindset…

4. They place their wants above their needs.

They don’t NEED it, they WANT it!

It’s difficult to say this to people, sometimes, but it’s the truth. It’s okay to want things.

We all want things, but it doesn’t mean we should buy them on impulse.

Think about it for a few days, weeks, or months, depending on how expensive the purchase is.

It can be very tempting to make purchases.

With technology and information overload, we are constantly bombarded with advertisements and social media influencers showing off their shiny new cars, outfits, and shoes BUT that doesn’t mean we should fall for the marketing tactics, which is an entire problem in itself, leading to my next point.

5. They fall for the advertisements.

Advertising is amazing for businesses, but bad for people who spend more than they have.

Just because something is advertised a certain way doesn’t mean it actually performs that way.

People need to do RESEARCH before they make purchases.

If a product or service is too expensive, there is nothing wrong with finding an alternative that is cheaper.

If anything, a smart shopper will do this no matter how much they have in their savings accounts.

Explore all possibilities. Check Amazon, Costco, the 99-cent store, Walmart, and eBay, to compare prices. Find out when the next sale is and what their return policy is.

AND DON’T FALL FOR THE STORE CREDIT GIMMICK!

Oftentimes, we are being sold to or advertised to without even knowing (and from a business perspective, that’s the best kind of marketing).

6. They care too much about CLOUT.

7. They don’t have self-control.

There’s no need to over-complicate it.

Many Americans unfortunately don’t have self-control when it comes to how they spend their money. They buy things they see on Instagram, TikTok, or YouTube.

Before making a purchase, Americans should take a moment to think about whether or not they really need the item.

How much “joy” and VALUE will this will truly bring them?

Americans need to give their purchases at least a day, week, or few months of thought, depending on how expensive the purchase is.

Consider how many times the product will be used and if it’s worth the splurge.

If it takes more than a week to consider the purchase, it most likely isn’t needed.

Spend wisely.

8. They don’t think about the future.

People who spend their money (without good reason) do not think about their future.

It’s very simple.

Every American who struggles to save their money must ask themselves the following questions:

- Do I want to own a house?

- Do I want to be free, financially?

- Do I want to be in debt?

- Do I want to have a family?

- Do I want to travel?

- Do I want to start a business?

- Do I want to retire early?

- Do I want to get married?

- Do I want to move?

All of these things require money.

It would serve their best interest if Americans thought about their future selves every time they went to spend their money on a restaurant, car, or clothing they didn’t need.

It’s not easy, but it’s easier than the stress one will face while broke.

9. They keep increasing their budget as their salary increases.

64% of Americans live paycheck-to-paycheck.

Americans’ salaries go up and they think it’s an opportunity to upgrade their car or home, and to splurge on more things.

This is completely irresponsible.

Unless they get a massive bonus or salary increase (such as an additional $50,000 a year +), most people simply cannot afford these upgrades.

And anyway, these circumstances are extremely rare for most people, unless you’re an entrepreneur, in which case, the permanent increase in income isn’t guaranteed so they would still be taking a tremendous risk spending it so quickly.

Many Americans have a tendency to increase their spending habits as their wages increase.

This is the unfortunate reality of our society.

Rather than putting some cash aside to create a safety net for themselves, in case God forbid, they need the cash for something they *actually* need, people are quick to throw it down the drain by spending it on something they wanted on impulse.

10. They care too much about what other people think of them.

There is nothing wrong with telling people, “I CAN’T AFFORD IT.”

The sad reality is that this is why many people buy things they don’t need – to impress others.

Unfortunately, these insecurities can be quite costly.

As a result of people caring so much about what others might think of them, they spend money to appear a certain way – with money they don’t have.

The sad truth is that humans can be very insecure.

We all know this because we all struggle with our own. However, people should never let their insecurities cost them money (especially if they don’t have it).

The Secret to Wealth

The secret to wealth is not spending money just because it’s sitting in savings.

Save everything, keep expenses to a minimum, and find ways to earn more.

Be stingy, with pride, until you can afford not to be.

***Opinions by Valuetainment contributors are not reflective of Valuetainment Media***

ABOUT THE CONTRIBUTOR:

Elena Patestas is a journalist and writer for Valuetainment media. She attended Pepperdine University in Malibu, California, and Adelphi University on Long Island, New York. She was born and raised in Roslyn, New York, and currently lives in Miami, Florida.

Elena is passionate about bringing positive change to our world and believes education is the root to solving many societal problems. After overcoming a chronic health condition, Elena became passionate about health and believes food is the key to preventing dis-ease and achieving optimum health.

Amongst her many goals, she hopes to bring positive, impactful change to our world to create a healthy, financially sound, and unified society.

Add comment